- ARTICLE

Navigating Tariff Turbulence

Procurement Strategies for Resilient Port Operations

May 2025

Resilient procurement can turn tariff turbulence into a competitive edge. Port CPOs must lead this shift, ensuring terminals remain viable and efficient even as trade winds change.

Tariffs are becoming the new normal. Is your port ready?

Global port executives could be forgiven for thinking they have done enough. Having weathered a pandemic, regional conflicts, and sweeping regulatory shifts, Chief Procurement Officers (CPOs) have spent recent years building more supply chains. But in a world where tariffs are becoming a threat to global trade, “resilient enough” is no longer enough.

While tariff negotiations continue around the world, some U.S. tariffs have already come into effect. In May 2025, Fitch Ratings estimated that the effective US tariff rate on Chinese goods stand at 31.8%, far higher than the global average of 13%. Meanwhile, steel and aluminium duties have expanded to include countries that were previously exempt.

Author

Related Services

These changes are cascading through port operations and impacting budgets as a result. Commodity prices – including natural gas, steel, copper & lumber – have surged, pushing construction and maintenance costs sharply upwards. The U.S. construction input prices rose at a 9.7% annualized rate by March 2025, its biggest jump in years. Port expansion plans and maintenance budgets can no longer assume cost stability.

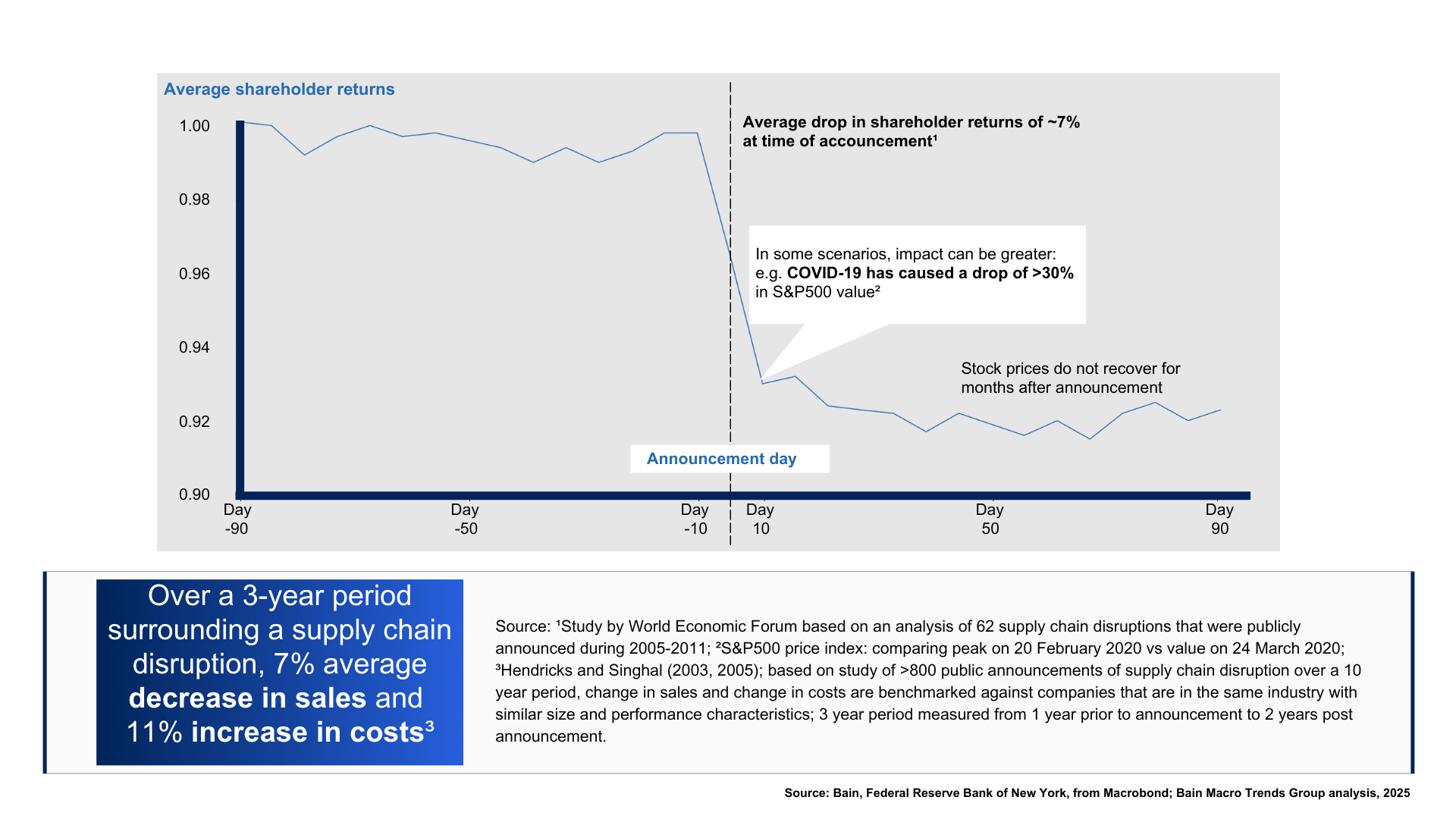

And the impact isn’t limited to infrastructure. Supply chain disruptions are estimated to lead to a 7% decline in sales and an 11% increase in operating costs over a three-year period. Shareholder returns are also likely to take a hit, with share prices often taking months to recover after such shocks are made public.

Today, CEOs are turning to their procurement and supply chain leaders to weather the storm. CPOs must recognize the dual risks tariffs pose – to both capital expansion projects and day-to-day operations – and take decisive action.

CAPEX Under Pressure: Port capital projects face steep inflation and uncertainty

“Dear valued customer” letters warning of tariff-related price hikes have started circulating from suppliers to construction firms. U.S. contractors are bracing for the impact of duties on Canadian and Mexican steel, aluminium, and lumber. Reports indicate that they have already driven up prices for rebar, structural steel and curtainwall systems.

Even without full implementation, the threat of tariffs are pushing up reinforcing steel and lumber prices. Core capital items for port infrastructure, namely reinforced concrete, heavy machinery and prefabricated structures, are all caught in this upsurge. Ports need to rethink their contingency allowances threshold and contractual terms. Think about this: Today’s fixed-price contract could turn unviable if steel costs jump 20–40%.

OPEX Squeeze: Tariffs pressuring day-to-day operations

While attention often focuses on major capital projects, operating expenditures (OPEX) are feeling the squeeze as well. Imported spare parts, equipment components and chemicals are becoming more expensive. Equipment makers’ inputs – specialty steel, electronics, batteries – are already reporting 15–40%¹ higher landed costs.

Maintenance contracts and MRO procurement must account for higher duties or restricted sourcing. Even utilities and energy inputs can be affected: new U.S. levies on Chinese solar panels and battery components (i.e. 25% on EV/battery parts) will translate into more costly power and charging infrastructure.

Freight and logistics budgets are also under pressure. With tariff uncertainty making planning difficult, global shippers are in a holding pattern. Ocean carriers and trucking firms are renegotiating rates, and some ports have added surcharges that could be passed to terminals. The result is higher costs across fuel, parts, and service contracts, driven by a combination of tariffs and inflation.

Shifting Cargo Flows and Investment Patterns

Furthermore, tariff regimes are re-routing global trade with direct implications for ports. The Port of Los Angeles – America’s busiest – saw a 35%² drop in weekly imports in early May 2025 versus a year earlier, after U.S. imposed punitive tariffs on Chinese goods. Dozens of vessel arrivals were cancelled, and retailers’ inventories plunged. This abrupt decline is more than a blip: industry forecasters now project U.S. port throughput could fall 15–20% in 2025. Such swings send shockwaves to investment plans. Terminals budgeting new gantry cranes or warehousing must account for lower base volumes and unpredictable timing. With the model of low-cost, China-centric supply chains in disarray, port networks may see years of adjustment ahead.

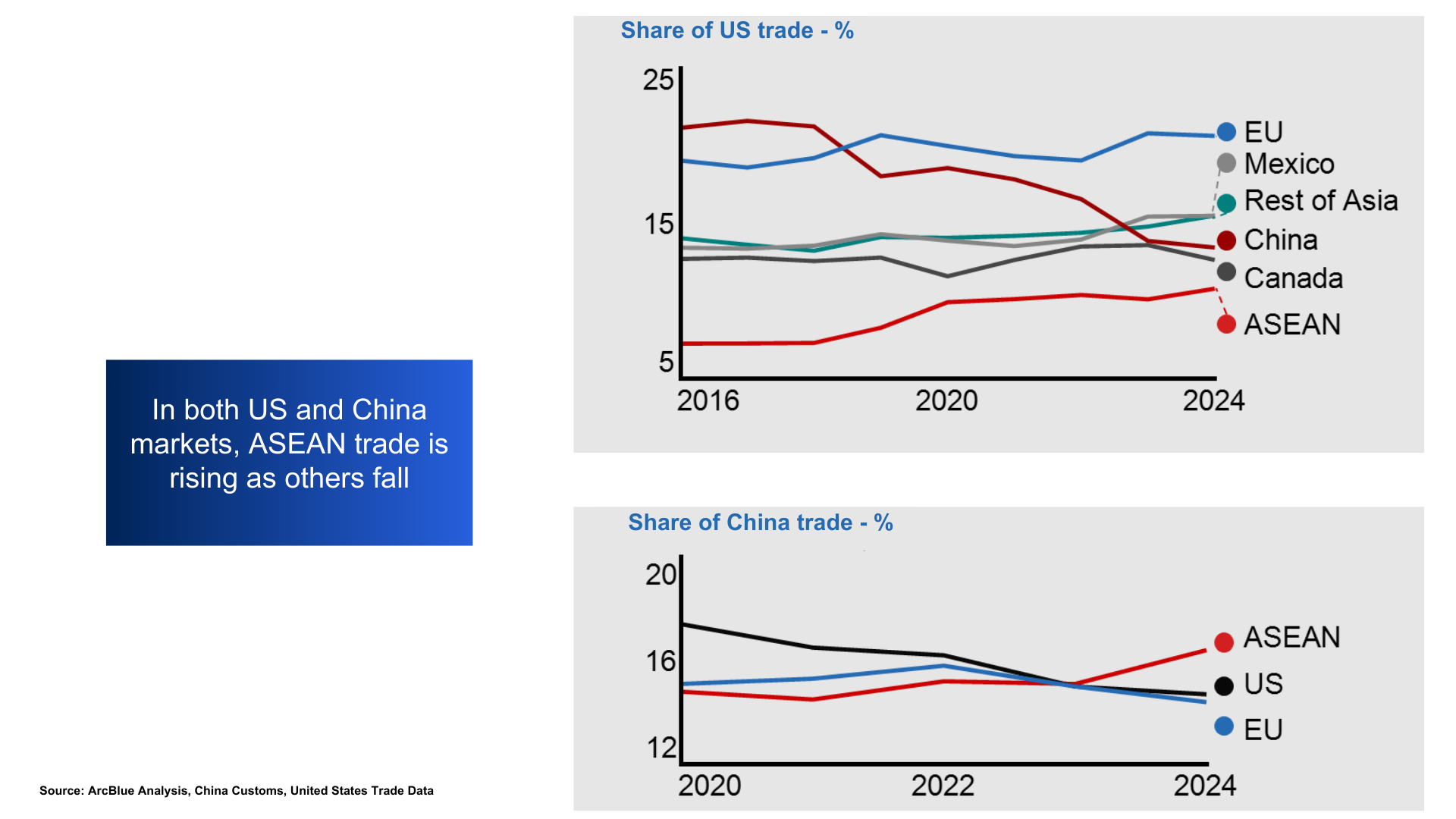

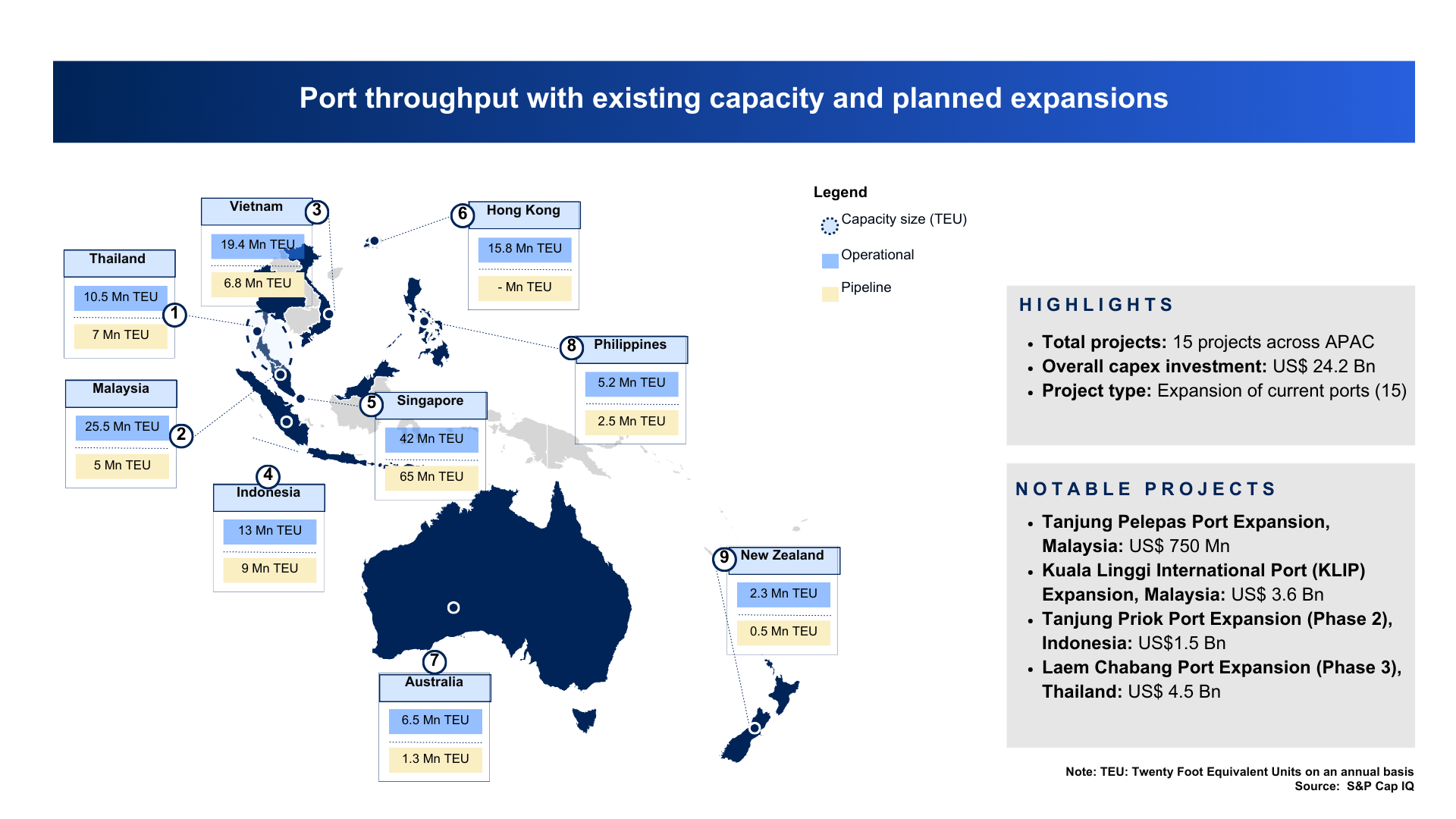

But while some cargo volumes shrink, others shift. Initial demand may be front-loaded before a lull, with trade flows eventually stabilizing through new routes. ASEAN ports, in particular, are rising in prominence as critical hubs for global interconnectivity. In both US and China markets, ASEAN trade is rising even as other regions see declines. APAC ports have earmarked over $25 billion for planned expansions, and ASEAN ports are set to increase TEU capacity by 70% in the coming years.

For forward-looking ports, this represents a unique window of opportunity. Those that move quickly to capture shifting volumes can turn today’s turbulence into tomorrow’s growth.

Of course, these shifts won’t happen overnight. Moving supply chains takes time – rebuilding capacity in Vietnam, India or Mexico is not instantaneous. Further, as countries respond to market forces, this unpredictability requires Port CPOs to be vigilant and double down on resilience. CPOs must work with planners to assess which capital projects can be delayed, while preserving options for future rebound.

What can procurement leaders do?

With the right strategies and meticulous implementation, CPOs can turn procurement into a strong defensive posture against the shocks described above. We recommend five core actions every CPO need to consider.

1 – Scenario Planning

Embed tariff risks into strategic planning. Develop multiple budget scenarios based on varying tariff levels to understand impacts on P&L and cash flow. For example, model how logistical delays (e.g. global container transit times jumped +12–18 days under recent disruption) can affect berth capacity and storage needs.

By building a range of scenarios, CPOs can work with finance and operations to set realistic budgets and identify which projects are truly mission-critical and which are deferrable.

2 – Category Strategy

Identify and isolate high-risk spend categories—steel, heavy equipment, electrical systems—for immediate review. Overlay tariff data to understand where impacts are sharpest.

Explore material substitutions (e.g., composites or modular systems) and standardize designs to ease sourcing. Work with engineers on design flexibility so substitution is possible if import prices spike.

3 – Forward Purchasing and Stock Buffers

Accelerate purchasing where possible to lock in current prices. Build strategic inventory buffers for essential commodities like cables, motors, or steel beams. Operators who missed this step risk paying 15-20% premium on rushed shipments on critical inventory.

Further, CPOs should identify slow-moving but vital materials that can be bought ahead at predictable prices, while keeping an eye on storage limits and shelf life. Even fuel or diesel futures can be explored if energy costs from tariff moves continue to escalate.

4 – Supplier Diversification

Avoid single sourcing from tariff-vulnerable regions. Seek dual or multi-sourcing for cranes, machines or parts and where feasible, qualify local or regional manufacturers.

Developing these critical relationships with additional suppliers are critical to maintain resiliency. A diversified supplier base not only reduces exposure to tariffs but also improves agility in the face of disruption.

5 – Risk-Based Contracting

Review and update contract terms with suppliers and contractors that include clear tariff-adjustment mechanisms (e.g., price escalation clauses tied to commodity indices). In times like these it is critical to define Incoterms precisely to identify the party who pays these escalating duties (FOB vs CIF vs DDP).

Add force-majeure or hardship clauses that explicitly cover sudden tariff hikes. In practice, this means a crane purchase contract might let the vendor absorb any new import duty, or trigger price renegotiation if duties change beyond a threshold. Shipping and logistics contracts also need scrutiny to ensure carriers pass through tariff costs transparently.

CPOs Must Lead the Resilience Charge

Tariffs are no longer a hypothetical in the procurement playbook; they are a core consideration within today’s operating environment. Port executives must adapt quickly to protect both capital projects and operations budgets. This means weaving tariff-awareness into every procurement decision, from raw materials to long-term service agreements. CPOs must take the helm: championing data-driven category reviews, negotiating flexible contracts, and maintaining a constant watch on policy changes.

By acting decisively now – adjusting strategies, building stockpiles where needed, negotiating contracts and modelling risks – CPOs can turn tariff turbulence into a competitive edge.

INSIGHTS

RESOURCES & DOWNLOADS