- WHITEPAPER

Beating inflation against the odds

How procurement can win in a downturn

May 2023

Executive Summary

A gloomy global economic outlook with a backdrop of inflation has set the stage for the remainder of 2023. According to the World Economic Forum’s Chief Economists Outlook report1, the biggest challenges for businesses to overcome this year are weak global demand followed by the high cost of borrowing, high input costs and talent shortages.

The WEF briefing reports 86% of economists surveyed expect businesses to respond to economic headwinds by cutting operational expenses, while 78% predict businesses will make cost savings by laying off employees, and 77% expect businesses to optimise supply chains.

The priorities for procurement for 2023 include tackling cost optimisation, navigating the procurement talent shortage and pursuing digital transformation2. This combination of issues is forcing procurement to rethink its value proposition. Traditional tactics to find procurement savings are no longer working and to generate value for their businesses in this climate, the function will be challenged to think strategically about sourcing, talent, digitalisation and supplier relationships. In this report, we discuss key strategies for procurement to weather this economic storm and ultimately help their organisations move towards a more innovative future.

Produced in partnership with:

Authors

Related Services

Part 1: Challenges for procurement to manage and contain costs

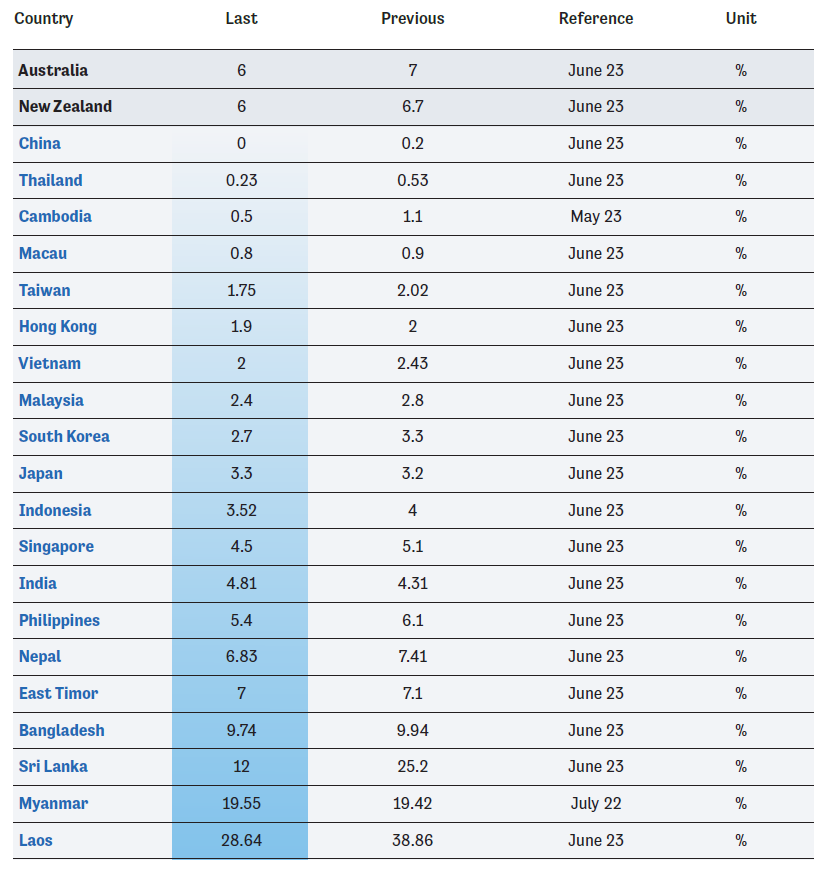

How inflation is impacting supply chains

The monthly headline inflation figure for Australia has come in at an annual increase of 5.6% for the 12 months leading up to May 2023. Although this is down from April’s monthly rise of 6.8% and from the 30-year high peak of 7.8% for the December quarter of 2022, prices for most goods and services are still increasing.3

Meanwhile, inflation in developing Asia is forecast at 3.6% this year and in the Pacific subregion as a whole, inflation is set to moderate to 5.0% in 2023 and 4.4% in 2024.4

Across the region, rising prices for food, rent, mortgages and fuel are hitting consumers hard, leaving them with less to spend on non-essentials, in turn shrinking demand for goods and services. On top of this, inflation is driving up costs for labour, materials, energy and transportation, making it more expensive for organisations to manufacture, store and ship their products. In a perfect storm, the RBA has increased interest rates, meaning companies with debt or financed equipment are now facing higher cost pressure.

As a result, suppliers are putting up their prices, sometimes passing through double-digit price increases to customers. To navigate this volatile environment, procurement needs to go beyond the standard methods of managing cost and delivering cost savings. Instead, the function requires a far more sophisticated approach to create value.

“Rising prices for food, rent, mortgages and fuel are hitting consumers hard, leaving them with less to spend on non-essentials, in turn shrinking demand for goods and services” Chris Hodgson, Executive Director, Strategic Initiatives at ArcBlue explains that the traditional procurement levers of negotiation, aggregation and volume optimisation have become less effective at delivering procurement savings because the baseline is moving.

Inflation Rates Table

Sources:

www.tradingeconomics.com/country-list/inflation-rate?continent=asia | www.tradingeconomics.com/country-list/inflation-rate?continent=australia

To address rising costs, Hodgson explains that procurement needs to have a deep understanding of supply markets; the cost drivers, the risks and innovation for the supply market, as well as the legislative and regulative factors impacting the market. It means understanding all the macro-economic and political factors that influence the market from either a cost or a risk perspective.

“Practitioners need to understand their own business and how it creates value, and understand their supply markets and how they create value” Chris Hodgson, Executive Director, Strategic Initiatives at ArcBlue.

With the complexity now involved to find cost savings, to succeed in this market, it’s clear that procurement practitioners need considerable skill and knowledge. Yet, the procurement function is currently battling a global talent shortage5 and these skills are in short supply and high demand. Hodgson explains that larger organisations with bigger salary budgets are snapping up the more experienced professionals while smaller organisations are losing out. These same organisations are finding themselves cutting headcount to combat rising costs and procurement roles are not safe from the chopping block. Hodgson explains that even organisations that are aggressively cost cutting are still laying off employees and losing valuable procurement people, ironically people who could help solve the cost problem.

With the squeeze on talent, it’s even more important for companies to be investing in the talent they do have. Yet when it comes to understanding supply markets, Hodgson doesn’t believe many organisations put enough thought into genuine category management. “There are a lot of organisations that have category managers, but they become a sourcing shop turning over contracts and they’re not provided the training or capacity to do the deep internal and market analysis work,” he says. “Practitioners need to understand their own business and how it creates value, and understand their supply markets and how they create value. Once they have understood where real value gets generated, they may find that there are alternative supply markets or alternative solutions. All of that takes time, effort, expertise and with the talent issues, organisations probably don’t have these people. And if they do, they’re probably not affording them the capacity and time to do the deep, detailed work.”

Part 2: Thinking differently to find cost savings

So what steps can organisations take to make headway in this environment?

Thinking differently is crucial when it comes to procurement savings and Hodgson puts forward some non-traditional strategies.

He explains that one of the simpler levers for organisations to pull is demand control and compliance. Organisations can begin by controlling costs that have a discretionary element such as business travel, office stationery costs, or the contingent labour workforce. “By looking carefully at the number of people in your business, your contractors, how you consume consultants and professional services, you can identify whether these spend categories are growing out of control or causing your organisation ‘leakage’,” he explains.

“For example, you may have a preferred IT services panel who you’ve negotiated discounted rate cards and onshore/offshore resource mixes with but over time, if this isn’t managed, internal consumers, influenced by skilled sales people, may end up using higher cost Tier 1 providers over the Tier 2s, as well as onshore consumption creeping up.” This is one of the easier-to-design but harder-to-implement strategies because of resistance from within the business.

“By looking carefully at the number of people in your business, you can identify whether these spend categories are growing out of control” Chris Hodgson, ArcBlue.

“You need the change management skill set to be able to execute on this,” adds Hodgson, “but if you do the analysis and can identify what’s driving the increased volume in these more discretionary buckets of spend, there’s often a way that you can influence that demand.”

Hodgson stresses the importance of reporting successes and showing the impacts of decisions on different business units. “Close the loop – do the analysis, design the initiative, design the execution and the change management, and go all the way through to reporting out the success so that people can see that the benefits have flowed through,” he says.

At the other end of the spectrum, businesses can take a more traditional ‘make vs buy’ approach where an organisation considers services or tasks that are carried out internally and weigh up whether these could be done more efficiently and at a lower cost by an outsourced provider. This also works the other way around where businesses consider what they have outsourced and question whether it is still competitive from a performance, risk and cost perspective.

“For example, within the IT space we may have outsourced managed services where we’re paying a provider to run our environment but we notice the cost has started to climb and get out of control, and we’re not seeing productivity initiatives or innovation come from the suppliers,” says Hodgson. “In this instance, there may be a tipping point where some of those outsourced services would be better off coming back in-house.”

A design-to-cost approach

In a monopolistic market, where businesses are buying from a supplier and there aren’t genuine alternatives, organisations can pull ‘spend better’ levers such as value engineering and design-to-cost. This is where businesses adjust the specifications or change the requirements from a cost perspective, essentially reengineering what the organisation needs to deliver the outcome to a standard that is acceptable but doing so at a lower cost.

Hodgson has an example. “We work with manufacturing companies where they’re selling a product to consumers and there’s a price point that they need to hit but input costs are increasing: raw materials are increasing, packaging is increasing, labour is increasing,” he says.

“They can’t simply pass all of that through to the consumer because the consumer will stop buying the products at volume. Instead, we need to take a design-to-cost approach and look at how we can still produce the product to a standard and quality that consumers will buy but change some of the inputs. If we’ve traditionally packed food products in a metal can but there’s scope to move that into a lower cost, blow-moulded package, there can be a significant cost decrease. Of course, you need to be confident that there’s no impact to shelf life and quality of the product.”

It stems back to the need for a deep understanding of your business and supplier markets. Organisations can find procurement savings along the whole supply chain, from raw materials, packaging, transport and warehousing. “We’ve seen examples where clients had been importing manufactured goods from China and other parts of Asia and containers were not fully optimised so we had heavy metal equipment packaged in a container with air space above it,” continues Hodgson. “The container costs the same price whether it’s half-empty or full so if we could fill the space with lightweight goods such as plastics, then we get a value kick out of that.”

When (and how) to consider supplier price increases

As part of a category plan, procurement needs to develop a cost model for their market with a good understanding of the core inputs into that supply chain. Using contingent labour as an example, inputs include the wage for the individual, taxes, superannuation, leave loading, and recruitment and payroll fees. “Armed with that data and breakdown, if a supplier tries to exploit the situation using the current climate to boost what would perhaps be a smaller price increase request, if you have the model you can very quickly see through what is real and what isn’t,” says Hodgson. “When it is real, your course of action is to use a full deployment of your negotiation skill set. It is then leveraging the relationship and using persuasion and all your tactics to try and convince the supplier to absorb some of that price increase.”

Building longstanding and collaborative supplier relationships founded on trust is a good way to manage cost increases. A gain share is a more collaborative value engineering process where procurement can work strategically with a supplier to collectively understand buyer behaviours that create cost for the supplier, as well as tactics the supplier could apply or change to drive its own costs down. If both parties agree to make these changes, the benefits can be shared. “Sometimes the supplier needs an incentive to change their behaviour; alternatively there might need to be an incentive for the supplier to invest in that opportunity,” says Hodgson, “We’re talking about ripping apart the supply chain and understanding the value, not a small task by any means. But if you’re given a price increase and it is a really material change for your business, you should be investing in this level of strategic work” Chris Hodgson, Executive Director, Strategic Initiatives at ArcBlue, “but having that conversation also gives you a better understanding of how the supplier operates and what drives costs for them, helping you to further improve your knowledge of the market.”

Hodgson stresses that these tactics are not easy but given the environment, this is the level of complexity the role requires. “We’re talking about ripping apart the supply chain and understanding the value and that is not a small task by any means. But if you’re given a price increase and it is a really material change for your business, you should be investing in this level of strategic work.”

Strategies to manage the talent shortage

Procurement professionals today need to be business problem solvers. In the Proxima 2023 CPO Report6 Rob Turner (former Head of Procurement at Amazon Fresh), states that: “Building a procurement team in the coming year means looking beyond years in the industry and identifying people who can foster strong internal relationships, look beyond a category plan, and build strong commercial relationships… From ideation to delivery, it’s about how people can work across the business to effect change.”

In the midst of a talent shortage, it’s good advice as organisations have little choice but to think outside the box. Organisations upskilling and training existing staff, even transitioning employees from other areas of the business, can create a team of strategic buyers and problem solvers who are aligned on a vision and given the trust and freedom to deliver on it.

“Looking externally for new staff is expensive, time consuming and comes with risk. Instead, you must create a culture and commitment to staff to give them opportunities for growth, which in turn benefits the organisation,” says Dympna Wong, Director at ArcBlue Search. “Not only does this ensure existing staff feel valued and enable them to adapt to changing environments and market needs, but it will also make your organisation attractive to job seekers and strengthen your reputation as an employer.”

Part 3: Looking to the future

To set your organisation up to minimise the impact of future inflationary pressure and risks, Fiona Nissen, Director at ArcBlue New Zealand recommends robust supplier relationship management. Where there is a high level of trust between organisations, suppliers are more likely to voice concerns early and be more prepared to work with their customers on how to best mitigate risks and difficulties in the supply chain.

To build this sort of collaborative relationship, Nissen says procurement needs to look beyond the contractual engagement and create personal relationships. “It’s about building trust through having people-to-people engagements at an appropriate level where you can be empathetic and collaborative,” she says. This way, suppliers and organisations can be transparent and take a shared responsibility to risk. “Sharing accountability and being clear what the risks are, what the strategy to mitigate that risk is, and what role the supplier needs to play is key,” says Nissen before adding, “identifying the risk and the likelihood and impact of the risk is all very good but you then need to build appropriate controls to monitor the risk and show when things are deteriorating.”

1 Security of supply wins out over cost

“Traditionally face masks are sourced out of low-cost countries but during the pandemic, the price of those masks became less of an issue than their availability,” says Hodgson. “We worked with clients who invested in local manufacturing facilities so they could expand and produce high volumes. Was it cheap? Probably not. But did it keep the supply chain running and keep the product flowing in? Absolutely, 100%.”

2 Cross-functional collaboration for competitive advantage

Supply shortages and price increases provide incentives for other business departments to collaborate on sourcing. In this example from Bain and Company7, the procurement team at a mining company was faced with a 170% increase in transport costs for internal material movements. Faced with this, procurement teamed up with operations to develop an updated production forecast model that smoothed out transport hiccups and reduced annual costs by nearly 25%.

3 Digitalisation to enhance visibility in the supply chain

For Russ Stewart, Senior Vice President, procurement at Tyson Foods, every senior leader in procurement needs to have a digitalisation roadmap that leverages an open-source approach. “First, you have to focus on the core of your ERP and source-to-pay processes. Then it’s vital to have a multi-year digitalisation roadmap that acts as your north star for what you want to achieve and how you want to get there,” he says.

The land rush of technology in the procurement sector opens opportunities that can benefit all procurement leaders. Digitalisation can help break down siloes and make supply chains fully transparent – to suppliers, transporters and customers. Investing in the right solution can allow organisations to see into the supply chain more easily and run analytics to identify risks, modern slavery, supplier performance, as well as opportunities for sustainability and cost savings.

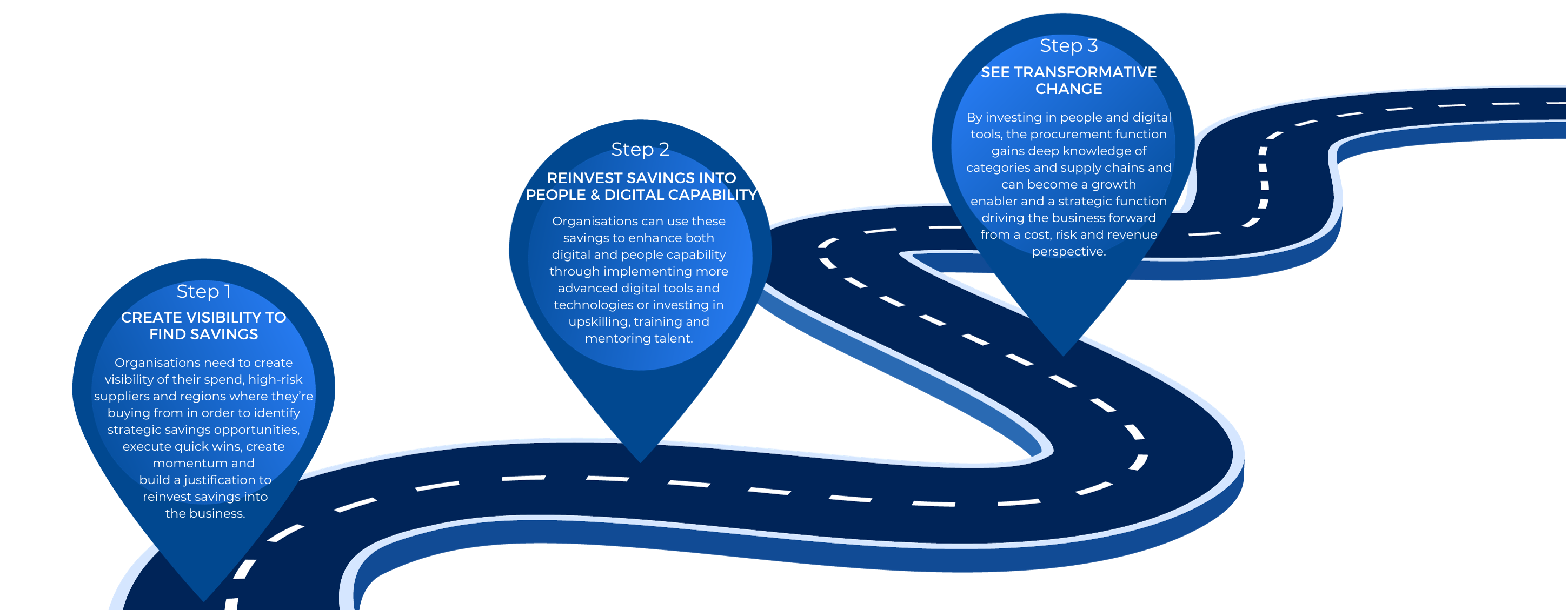

Road to transformation

Hodgson has a three-step plan to help organisations rise above the challenges of inflation, maturing and elevating the procurement function to deliver tangible value for the organisation.

Step 1

CREATE VISIBILITY TO FIND PROCUREMENT SAVINGS

Organisations need to create visibility of their spend, high-risk suppliers and regions where they’re buying from in order to identify strategic cost savings opportunities, execute quick wins, create momentum and build a justification to reinvest savings into the business.

Step 2

REINVEST SAVINGS INTO PEOPLE AND DIGITAL CAPABILITY

Organisations can use these savings to enhance both digital and people capability through implementing more advanced digital tools and technologies or investing in upskilling, training and mentoring talent.

Step 3

SEE TRANSFORMATIVE CHANGE

By investing in people and digital tools, the procurement function gains deep knowledge of categories and supply chains and can become a growth enabler and a strategic function driving the business forward from a cost, risk and revenue perspective.

For procurement to maintain its place at the centre of strategic business leadership, a place cemented during the recent years of volatile supply chains, transformative change is needed once more. Procurement and organisation leaders will need to devote time and energy to nurturing teams and promoting personal development and dynamic thinking. The strongest supplier relationships are true partnerships and these will be critical in managing price increases and finding new solutions to challenges. With deep market knowledge and strategy, procurement can protect organisations from economic pressures today while also setting the foundation for organisations to grow and gain economic advantage when the downturn shifts.

Sources:

- World Economic Forum Chief Economists Outlook, Jan 2023

- Proxima 2023 CPO Report: What’s next for procurement, March 2023

- Australian Bureau of Statistics Monthly Consumer Price Index Indicator, June 2023

- Asian Development Bank Asian Development Outlook: Key Messages, July 2023

- Supply Management Insider and ArcBlue, Building resilient procurement teams: The skills needed to shape the future, May 2023

- Proxima 2023 CPO Report: What’s next for procurement, March 2023

- Karen Stansfield et al, “Procurement’s Twin Challenge: Managing Inflation and Supply Shortages” Bain and Co, June 2022

- Proxima, “2023 CPO Report: What’s next for procurement” March 2023

The ArcBlue Savings Accelerator delivers an average return on investment of 15 to 1. Our experienced team can quickly cleanse, categorise and analyse your spend, and work with you to identify opportunities to take cost out of your organisation. We have a wealth of experience to draw from across a range of industries and categories and use our deep analytics skills to uncover opportunities. We’re trusted by our clients to deliver sustainable cost savings, not just short-term savings.

Speak to us about how we can use non-traditional strategies to take costs out of your business quickly in this inflationary market. Find out more.

INSIGHTS

RESOURCES & DOWNLOADS